If you were interested in student loans during the previous year, you would know that the rates were effective till July 2021. Now, it is time for student loan rates to change.

The change was long-awaited because borrowers expected loans to become cheaper. Unfortunately, the events indicate otherwise; student loans are becoming more expensive for borrowers. New interest rates are higher than what was offered during the previous year.

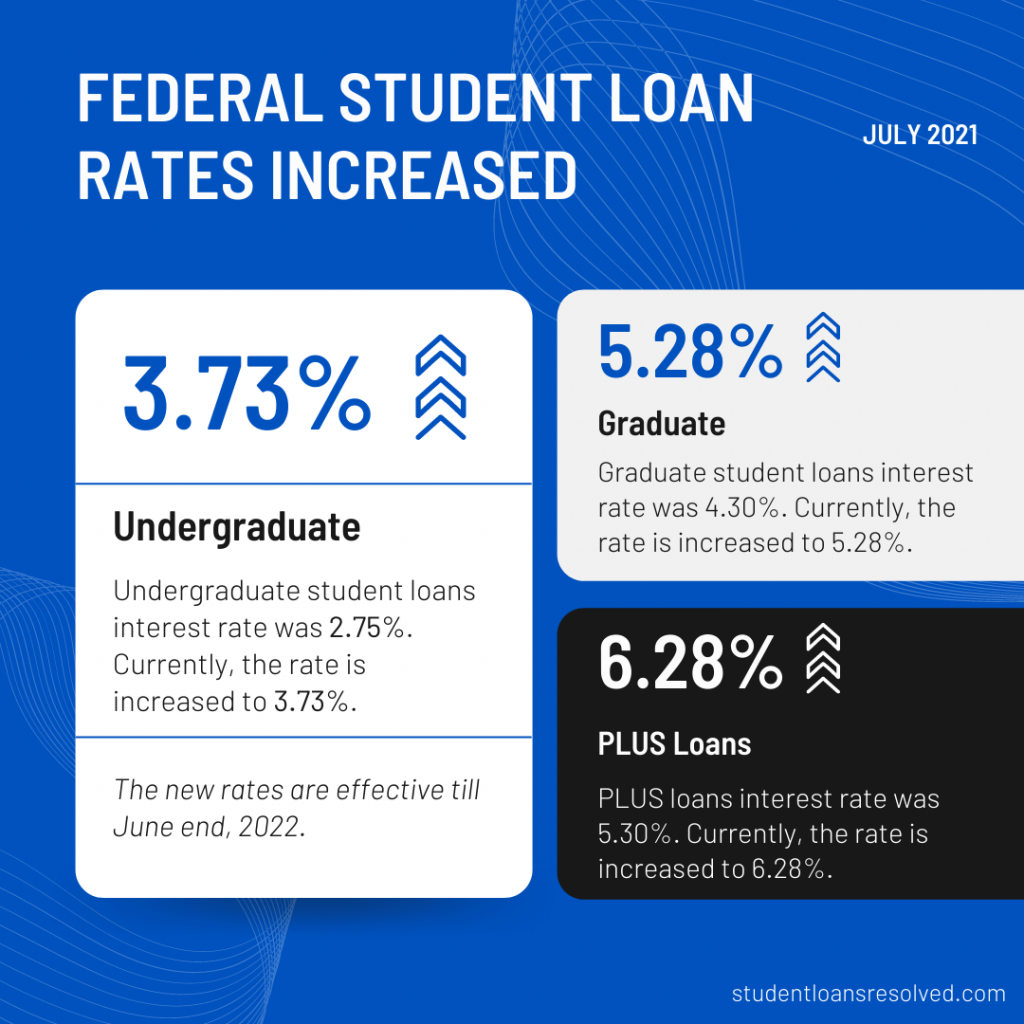

The rise in interest rates is around 0.98% for undergraduate, graduate, and PLUS loans. Here are the details:

1. Undergraduate Student Loans

Undergraduate student loans are either subsidized or unsubsidized. While Subsidized loans are distributed based on the financial needs of borrowers, Unsubsidized loans do not require a financial base. Hence, usually, Subsidized loans are cheaper than Unsubsidized loans.

Previously, the interest rate for Subsidized and Unsubsidized undergraduate student loans was 2.75%. Currently, the rate is increased to 3.73%. Yet, it continues to be cheaper than other federal student loans.

2. Graduate Student Loans

Graduate student loans can only be Unsubsidized. There is no financial need-based federal loan option for graduate and professional students. These loans are generally more expensive than undergraduate Unsubsidized Loans. The previous rate for the loan was 4.30%. This year the rate increased to 5.28%, which makes such loans more costly for the borrowers.

3. PLUS Loans

Compared to undergraduate and graduate student loans, PLUS loans have always been more expensive. These loans are available to graduate students or the parents of dependent undergraduate students. In the first case, when it is for graduate and professional students, it is called Grad. or Graduate PLUS loan. When made to parents, these loans are called Parent PLUS.

The previous rate for these loans was 5.30% which is the new interest rate for Unsubsidized graduate loans. This year, PLUS loans require a 0.98% higher interest rate - 6.28% of the remaining debt balance.

Why Do Student Loans Become More Expensive?

Although the increasing interest rate news is disappointing, there is a reason behind it. Congress does not set these rates out of air. Instead, the officials auction 10-year Treasury notes to determine the upcoming year’s interest rates.

The good news is that new rates are effective till June end, 2022. So, maybe next year, loans can become less expensive.

Does the Change Affect My Student Loan?

If you already have a student loan, you do not need to worry about increasing interest rates. These rates are for loans taken after July 1, 2021. You will continue repaying your debt with the same interest rate. However, if you want to get a new loan during this year, you will need to deal with higher interest rates.

Do New Interest Rates Affect Private Loans?

No, these interest rates are set for federal student loans. Private lenders determine the interest rate for private loans, and they are not affected by the government’s decisions. For full information on your private loan rates, you can contact the lender.

Is the New Rate Fixed or Variable?

The new interest rate, or generally, federal student loans, provide fixed rates. It means, once you get your loan, its interest rate does not change during the payback period. This is why borrowers with existing student loans do not get affected by the interest rate increase.

Will the New Rate Apply for Paused Loans?

No, your paused loan will resume with your original interest rate. Expectedly, loan payments will continue from October if there is no decision to loan forbearance period further. Once you start repayment, you will continue affording the previous interest rate you had on your loan agreement.

How Can I Lower the Interest Rate on My Student Loan?

The best case to lower interest rates is through Student Loan Refinancing. Refinancing allows borrowers to get a new loan- preferably with lower interest rates. Then the borrower uses this loan funding to pay out existing, more expensive student loans. However, you have to find a good deal for the new loan for this method to work. Otherwise, you will continue the same repayment only with a new lender.