The student debt issue has become more challenging than ever. With the lockdown rules enforced in our daily lives, many people struggle to get a job or receive a decent salary for their commitments. Unfortunately, the educational debt of young Americans grows six times faster than the economy and that’s where private student loan forgiveness or relief comes in.

The government plays a huge importance in this problem as they know that student debt is the main problem of young people. Even during elections, the candidates try to attract attention with student debt relief claims.

However, almost none provides a solution to private student debt. It is possible to find forgiveness or affordable repayment options for federal loans, while they are not accessible for private loan borrowers.

Sure, one can claim that the private student debt is lower than the federal education debt, which is why it lacks attention. However, the private debt still accounts for $135 billion, which means more than 2 million students experience the struggles student debt brings.

Is Private Student Loan Forgiveness Possible Under Biden’s Administration?

Biden has consistently shown his support in canceling student debts. But he has refused calls from the progressive Democrats, including civil rights organizations, advocacy groups, and labor unions, to forgive $50,000 or more.

The president has made it clear that he would support $10,000 in student loan forgiveness. And even with that, he argued that any debt forgiveness should be aimed at lower-income borrowers.

But what about borrowers with private student loans? Would they benefit from any mass loan forgiveness? Here’s what you need to know.

About Private Student Loan Forgiveness

Commercial lenders such as schools, banks, non-profit or state-related lending officials, and other private companies offer private student loans. These loans usually come with higher interest rates and fewer repayment options compared to federal student loans.

You may also need a cosigner when you go for this option. Private student loans are different from the FFEL program. In the FFEL program, a private loan servicer originated a federal student loan that the government secured.

Such loans could qualify for specific federal forgiveness programs and loan repayment programs. And you could consolidate into a federal-owned student loan via the federal direct consolidation program.

But with private student loans, you can’t do any of that. You can’t access federal forgiveness proformas or consolidate them into a federal direct loan.

Biden Could Sign A Bill To Cancel Private Student Loans

The Biden administration has on countless occasions stated that Biden would sign the Congress bill of student debt cancellation. And there have been many recent proposals that private student loan borrowers could benefit from:

- In 2020, the House passed a bill that would offer $10,000 private student loan forgiveness to borrowers with financial difficulties due to the pandemic.

- Last year also, there was an amendment to the National Defense Authorization Act that would’ve offered a maximum of $10,000 in financial assistance to private loan borrowers.

- The Senate Democrats revealed the Medical Bankruptcy Fairness Act of 2021 in February. This bill is meant to improve several of the U.S. bankruptcy code, making it simple for student loan borrowers (including private loans) to discharge their debt in bankruptcy.

- Earlier in May, the House passed the Comprehensive Deb Collection Improvement Act. It will allow private loan borrowers, including their cosigners, to get rid of their student loans if they become totally and permanently disabled.

Even though these bills look promising, it’s still a long shot, especially when the Democrats need the Republicans to agree to get a unanimous vote. However, it’s possible to get a significant private loan cancellation.

Until then, you’ll need to find any available options that can help you pay off your private student loans. Below, you’ll find various options for private student loan forgiveness.

Know Your Options

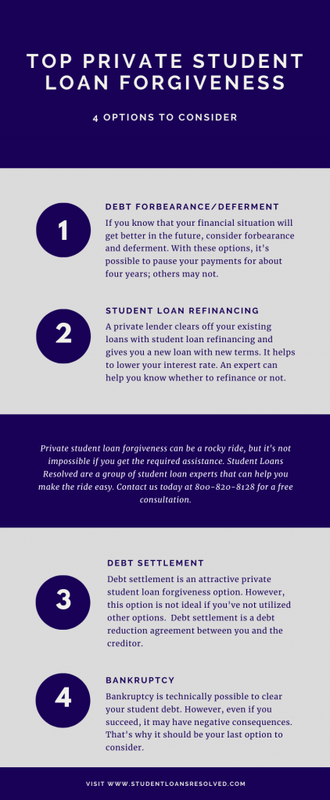

The government can be slow to offer private student loan relief. However, we do our best to help such borrowers who feel trapped in a debt spiral. We cannot promise you forgiveness programs as effective as those offered to federal loan borrowers. Instead, we can discuss your options to reduce the debt obligations to take a deep breath and relax finally. In this guide, we cover solutions like:

- Debt Deferment/Forbearance

- Student Loan Refinancing

- Debt Settlement

- Bankruptcy

Get an Expert Help

We try to help as many borrowers as we can through our informative guides. However, we understand that not all borrowers have the skills to assess their challenges and choose the most suitable private student loan forgiveness option.

The eligibility information can be unclear, it can involve technical terms, and as time passes, the presented information can get out-dated. Therefore, the best strategy for a borrower should be getting a third-party debt specialist’s help.

Debt experts have the necessary financial background and years of experience, which allow them to determine the best relief options for borrowers. Besides, specialists, like those we work with in Student Loans Resolved, will be by your side and guide you through the whole process of reducing debt obligations. Contact us now to say “stop” to your debt worries.

1. Debt Forbearance/Deferment

Forbearance and deferment look like similar private student loan relief options because they both grant debt non-collection opportunities to borrowers for some period. During this period, borrowers are not required to repay the debt.

If you face temporary financial challenges, and you believe that your finances will get better in the future, you can utilize these options. However, there are two important considerations. First, not all private lenders will grant these options. Second, even if you stop debt collection, the interest will continue to accumulate.

Deferment Option

Lenders can grant forbearance or deferment for various reasons. Usually, your access to these options will be noted in the loan terms. Deferment is mostly accessible during the study period when the student does not work.

Hence, it can be possible to stop debt repayment for up to 4 years. Private student loan lenders like College Ave provide deferment options till the borrower graduates. Other companies like Ascent allow deferring the payments even during an internship.

Forbearance Option

Forbearance is usually granted due to specific economic challenges, military service, etc. If a natural disaster happens or a pandemic affects your financials, you can take advantage of this program.

Ascent and MEFA lenders allow forbearance if there is a natural disaster restraining you from the payment. Different from deferment, forbearance is a short-term solution. While deferment can be applied for four years, forbearance is usually granted for a few months.

Should I Choose Forbearance or Deferment?

The most suitable private student loan relief options depend on the given factors like the loan type of borrower, the multitude of the problem, etc. If you think that a few months of the non-collection period is enough, you can opt for forbearance. If you believe that your challenge is here to stay, loan deferment can be an option.

However, in most cases, it is the lender who decides which relief program you qualify for. Hence, it might be at the lender’s discretion to choose the right program. Some lenders will not deliver any help, neither forbearance nor deferment. Besides, keep in mind that in both cases, the interest will accumulate. Once the collection resumes, you will be required to pay the interest.

2. Student Loan Refinancing

If there is a single best solution for private student loan relief, it is student loan refinancing. Refinancing happens when a borrower gets a new loan and uses the money to pay off other existing loans. It might seem simple and non-effective, but refinancing brings many benefits if the new loan has better loan terms.

For example, when the Federal Reserve decreases the interest rates, it can be a good time to refinance the debt because the new interest rate will be lower. Besides, if you improve your credit score since the initial loan acquisition, you can get a new loan with more favorable rates.

Advantages of Refinancing as a Private Student Loan Relief Option

Refinancing brings more benefits than any other private student loan relief option.

- Refinancing multiple loans will generate a single loan from a particular lender. Hence, debt management will be easier.

- Refinancing is a fast solution if you face challenges in monthly payments.

- Student loan refinancing can improve credit performance as the borrower pays out the existing debt.

- It can save you money as you can get lower monthly loan payments and lower interest rates.

- You can change your variable-rate loans to fixed loans or vice versa.

Eligibility Conditions

Student loan refinancing has simpler conditions compared to many federal assistance programs. There are three main factors; stable income, good credit performance, and a co-signer. All three ensure that you will repay the debt.

A co-signer is a third-party who can guarantee the repayment if the borrower fails to meet the obligations. It is usually required when a borrower lacks other factors. For instance, if a student applies for refinancing, a co-signer can be necessary as a student might not have the desired income level to repay the debt. Besides, refinancing with bad debt is only possible through a co-signer.

The credit requirement for the refinancing is 600 or more. It is desirable to have a higher credit score because, in this case, the borrower will access more favorable loan terms.

Should I Refinance?

You might wonder if refinancing is the right private student loan relief option for you. If you do not get expert help, here are some requirements for you to consider. First, you need to satisfy all eligibility conditions.

Second, you need to have a private loan. Sure, federal loan borrowers can refinance their debt, too. However, such borrowers have access to more favorable financial aid programs, like government-provided forgiveness, discharge, or repayment plans. If they refinance, they can lose access to these programs.

Next, if you have a variable rate loan and the increasing interest rates make it more costly, you can refinance the debt into a fixed loan. Lastly, borrowers who improve their qualifications, such as achieving higher credit scores, can utilize this program because better qualifications mean reduced interest and monthly payments.

When not to Refinance?

There also exist times when refinancing is not desirable. For example, if refinancing prolongs the payback period, you might want to avoid it. Besides, if you have loan default status or previously declared bankruptcy, this private student loan relief option will not suit you. In such cases, the credit score is usually not necessary to enjoy the benefits of refinancing.

Lastly, if you have federal loans, consider federal loan consolidation, forgiveness, or other programs. If you do not have any other chance than refinancing, you can apply for this debt relief option for federal loans.

Refinancing for Multiple Times

Another benefit of refinancing is that borrowers can apply for it multiple times. Generally, the disadvantages of multiple applications are not significant because even the origination of loans is mostly cost-free.

However, it is better to ensure that you will pass the eligibility check. First, if you get a rejection, your credit score can be hurt. Second, if you refinance for the second or third time, more through credit checks can be applied.

Refinancing Bonus

Some lenders provide bonuses to increase the attractiveness of this private student loan relief option. You can access the bonuses if you sign-up, refer a friend, stay loyal, etc. However, keep in mind that bonuses are small benefits. Imagine having two options: one with a bonus, another with a low-interest rate. You need to get a second loan as a low-interest rate will bring more benefits in the future.

Besides, before you agree to accept any bonus, you need to read the terms carefully.

Application

The refinancing process involves multiple steps. First, you need to select the most suitable lender and program. You can check the eligibility conditions, terms of the loan, etc. Next, it is highly advisable to run a “pre-qualification” tool.

This tool is usually provided on the websites of lenders. By inputting relevant information, you know whether you will qualify and what rate you will get. Sure, the result is not 100% guaranteed. When you apply, your conditions can be different. However, this tool helps contribute to the decision-making process.

Besides, if you apply and get a rejection, your credit score can be lowered. In contrast, using the “pre-qualification” tool will not affect credit performance.

3. Debt Settlement

Debt Settlement is another attractive private student loan relief option, but it is not recommended to utilize this option until you exhausted all other options.

Debt settlement usually happens with the help of a settlement company. Borrowers reach to such companies and explain their challenges. After getting information about the total debt balance and the income, the specialists develop a saving plan. Instead of repaying the debt, the borrower allocates some money to a savings account every month. In this way, a considerable amount is collected after several months. Next, the settler offers this lump-sum amount in return for the debt owed to the lender.

The logic behind Debt Settlement

One may wonder why the borrower instead does not repay the debt. The main idea is that the lump-sum amount collected is usually less than what is owed. The lender can agree to get a lower amount because it is a lump-sum, one-time payment, not many small payments scattered over months and years. However, debt settlement is very risky.

Risks of Debt Settlement

As borrowers stop loan repayment during the saving period, they expose themselves to a huge risk. Lenders can anytime sue the borrower due to the non-payment. Besides, there is no guarantee that the private loan lender will agree to get a lower amount in return for the debt. Hence, this private student loan relief should be your last resort.

Why Do I Need a Debt Settlement Company?

You might think that you can be able to implement this relief option by yourself without getting help. However, there exist benefits of getting third-party guidance. First, experts have required communication skills. They will patiently explain the situation to the lender and use powerful messages to convince the lender to accept lower amounts.

Many borrowers can create disagreements, conflicts with the lender, which will make the situation even worse. Besides, usually, the lenders and debt settlement experts have a close network. It means lenders are more likely to listen to an expert rather than the borrower.

4. Bankruptcy

Bankruptcy is another private student loan relief option. It is technically possible to get rid of the debt through this strategy. Yet, it is almost impossible, and even if bankruptcy is achieved, it will bring immense negative consequences.

Therefore, bankruptcy should be considered if there is no other way of repaying the debt, and repayment will create issues for the borrower’s survival.

Bankruptcy Benefits

There exist a few benefits of loan bankruptcy compared to the downsides. When a borrower’s case is opened, the courts will put a restriction on the debt collection. It means the lender cannot demand the repayment. The lenders also cannot pressure the borrower through emails, calls, or wage garnishments. If the lender still pressures you, he/she will face legal consequences.

Another benefit is that bankruptcy can help to eliminate some debt types. Most dischargeable debt options are for credit cards or utilities. For student loans, it is hard to get a bankruptcy solution as the borrower has a degree that can bring future employment opportunities. Hence, you might not even be able to achieve success through this private student loan relief option.

Disadvantages

When we say that bankruptcy brings more downsides, we mean it. Bankruptcy affects credit performance dramatically. Its negative effects stay on credit reports for up to 7-10 years. If you want to apply for a job, a new car loan, get insurance, or rent an apartment, bankruptcy history can be a major barrier.

Another disadvantage is that bankruptcy can bring liquidation, which means the officials will get your assets in return for the debt- even your house can be risked.

Is Forgiveness Possible for Private Loans?

It is almost impossible to get forgiveness for a private student loan. A few lenders can grant forgiveness if the borrower dies or gets a permanent disability. This private student loan relief option can be similar to death discharge or total and permanent disability discharge for federal loans.

Final Words

Private student debt is a massive problem for more than 2 million borrowers. While the government offers federal assistance programs, it does not create an opportunity for private borrowers to get some relief. Hence, if you have a private loan, you need to find a solution by yourself.

This guide mentioned several options- forbearance/deferment, student loan refinancing, debt settlement, bankruptcy. Among all four options, the best solution seems like refinancing because it brings sustainable impact. However, the final decision should be made considering the challenge you face and each relief method’s benefits.

We tried to keep this guide simple to help as many borrowers as possible. Therefore, please check each program in detail before making a decision. Besides, it is expected that many borrowers will have a hard time understanding the eligibility conditions and application process.

In such cases, you will be better off by contacting a third-party debt specialist who can guide you throughout the whole private student loan relief process. Our specialists can choose the most suitable relief opportunity and help you with a seamless application. Take a step today toward a debt-free future.

FAQ

Is Forbearance Status due to COVID-19 applicable to private student loans?

Unfortunately, no. As mentioned, the government does not provide much help to private loan borrowers. The main reason is that such loans are distributed by private lenders, and the government does not have legal authority over them. Hence, the non-collection period till September 31, 2021, covered by the CARES Act, is not applicable to private student loans.

Can I refinance my bad debt?

If you have bad student loans, there is a high chance that you will not qualify for student loan refinancing. Refinancing requires a high credit score, and borrowers with bad debt might not meet this condition. However, there are a few lenders who can refinance such loans only if a borrower has a reliable co-signer.

How to check if I qualify for refinancing?

Some student loan refinancing companies have “pre-qualification” tools on their websites. Although this tool does not generate 100% correct results, it can help you to have some idea about the interest rates and, in general, if you qualify for this program.

What are my repayment options for private student loans?

The lenders decide on the repayment method. Hence, your repayment options will change depending on the lender you select. Generally, they might offer deferment for the in-school period. Once the borrower graduates, interest-only or interest and principal payment can be accessible. In rare cases, discharge due to total and permanent disability or death can be applied.