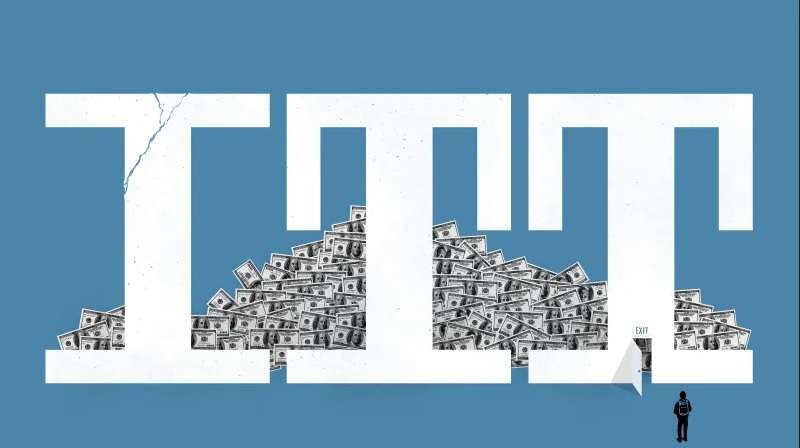

It’s been almost three years since the ITT Tech lawsuit made headlines. In a country like America, where most college students apply for federal student loans. The process and the outcomes of this lawsuit will forever remain a point of interest. The scammed students filed against the educational chain ITT Tech and won around 600 million dollars in repayments and cancellations.

It’s 2019 already, and more than a quarter of the total number of students still didn’t get their money. New lawsuits have emerged but also new conflicts that caught the public’s attention. We will talk about the most recent ITT Tech news, but firstly, we will break things down for those of you not accustomed to the infamous ITT Tech Educational lawsuit.

ITT Tech Lawsuit: The Beginning

ITT Tech Educational Services had more than 130 campuses in 38 different states until September 2016. The educational services chain shut down due to bankruptcy. Before doing so, the institution enrolled students that benefited from federal student loans. They were also issuing some temporary credits presented to the students as grants. Using this kind of misleading recruitment methods is what would soon get them. Shortly after closing their doors, the ITT Tech case gained popularity because of all the students claiming that debt collectors are still pursuing them for the money.

After one year since the first ITT Tech news emerged, the students filed their claim in court in January 2017. The former undergraduates had their law representation backed up by Harvard University through the Project on Predatory Student Lending. Secondly, Jenner&Block; LLP. Law firm joined the process. The students won, and the attorneys settled for a 1.5 million dollars claim against the company. It is essential to mention that the group of students is the largest group involved in a lawsuit in the history of the United States. The ITT Tech lawsuit had the following heads of accusation: consumer-protection violation, breach of contract and deceptive, predatory practices.

Statistics and facts

Another year passes by, and we find ourselves in November 2018, when ITT Tech lawsuit news started trending again. All because of a bankruptcy judge in Indianapolis. He gave the final approval for a 600 million dollars settlement affecting more than 750,000 students. The agreement covers former students who graduated from ITT Tech between 2006 and 2016, cancelling all of the debt for the students owing money directly to the educational institution. It also gives back 3 million dollars to former students that made loan payments to the school after it declared its bankruptcy. The only bad news, in this case, is that the agreement doesn’t cover the federal and private loans the students took out to pay for their tuition.

Out of 13,000 students that applied for student loan cancellations, only 33 received this federal financial aid. Other hundreds of thousands of former ITT Tech students are still waiting for their application approval.

The 2019 ITT Tech Updates

After sparking so many controversies, some related to Department of Education Secretary Betsy DeVos, there haven’t been that much recent news about ITT Tech lawsuit. DeVos is supporting the new Trump student loan plans instead of acting on them. This situation caused anger in the academic world and more than this; former ITT Tech students stepped up again for their justice.

In June last year, another student association filed a 250 million dollars lawsuit against the former ITT Tech Educational CEO, Kevin Modany and his fellow directors. This lawsuit is still left undecided.

Close to the beginning of this year, the Department of Education announced that they would approve around 150 million dollars in Borrower’s Defense to Repayment Discharges, including the students who attended ITT Tech and had to suffer from its actions. There is a particular application for ITT Tech students, and if that is filled out, your chances to receive student loan forgiveness are getting substantially higher. So, if you find yourself in this position, check your email regularly because the DOE stated they would cancel debt within 30 to 90 days.

The Public Service Loan Forgiveness Update

Despite the program being under many threats in the last couple of years, the Public Service Loan Forgiveness Program is still running. People are getting their loans forgiven, but the acceptance rate is still low. This program requires ten years of qualifying payments, so this means that many students that applied are still not eligible. The good news is, former ITT Tech students qualify for loan forgiveness, and in 2019 they have higher chances to benefit from this financial aid.

The Higher Education Act

The Higher Education Act governs a big part of the student loan system. Congress periodically reauthorizes and updates this law. Last year, two new acts came up for proposal: the Republican’s PROSPER Act and the Democrat’s Aim Higher Act. The first one eliminates loan forgiveness and changes the way federal student aids work. The second proposal increases federal funding, reduces payments for income-driven repayment plans and encourages the loan forgiveness program. The acts didn’t go through. This year, we are expecting a new change in the Higher Education Act that merges the two proposals. Hopefully, this is great news for students involved in the ITT Tech lawsuit as well.

School Closure

After ITT Tech closure news in 2016, more and more colleges in America choose to close their doors and leave their students in debt and with worthless degrees. The most recent school to shut down is Education Corp. of America, closing the most of its campuses until 2020. This decision affects around 20,000 students decision. While the transferring credits option drops because most of the universities do not recognize credits from closed institutions, the closed-school discharge is still on the table. As some of the ITT Tech students didn’t know, we need to remind you that you can not apply for closed school discharge and transfer credits at the same time. The two options cancel each other.

Closed School Discharges offer up to full forgiveness on any federal student loans. Good news for any ITT Tech students is that you are also eligible for reimbursements on the payments you already made to the Government. So if you were part of the ITT Tech lawsuit, check if you qualify for the Closed School Loan Discharge.

Student Loan Resolved

While we are on the ITT Tech news topic, Student Loan Resolved has the right solutions for you. If you are a former ITT Tech student, we can help you apply for the ITT Tech Loan Forgiveness Program. Our company can keep you up to date with any ITT Tech lawsuit news and changes that may occur and give you professional advice regarding what you should do. As many people don’t know all the facts about this case, we suggest contacting an expert to review your documents.

Student Loan Resolved is an excellent choice because we put our customers first and we make sure they can become debt-free in the shortest time possible. You can find us on our website or one call away, where we offer free consultations and assessments. So if you have any concerns about the ITT Tech lawsuit or you want to find out how can the recent ITT Tech news affect you, choose Student Loan Resolved.

Thank you for your reading. Join the conversation by posting a comment.